2024 Investor Presentation LAST UPDATED 03.06.2024

Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts or statements of current conditions, but instead represent only management’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that our actual results, financial condition and liquidity may differ, possibly materially, from the anticipated results, financial condition and liquidity in these forward-looking statements. The Company’s actual results may differ from its expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such forward-looking statements. The Company cautions readers not to place undue reliance upon any forward-looking statements, which are current only as of the date of this release. Results for any specified quarter are not necessarily indicative of the results that may be expected for the full year or any future period. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based, except as required by law. All subsequent written and oral forward-looking statements concerning the Company or other matters and attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. A number of important factors exist that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: the transformation of our business from a vertically-integrated, diversified lending platform to a modern retirement solutions platform, with access to an innovative range of retirement offerings centered on the home; our ability to obtain sufficient capital and liquidity to meet the financing and operational requirements of our business, and our ability to comply with our debt agreements and pay down our substantial debt; our recently closed asset acquisition from American Advisors Group and sale of our Commercial Originations and Lender Services businesses, and their respective expected benefits and increased liquidity, anticipated cost savings and financial and accounting impact; our ability to successfully and timely integrate the business of American Advisors Group into the legacy business of the Company; the possibility that the Company may be adversely affected by other economic, business and/or competitive factors in our business markets and worldwide financial markets, including a sustained period of higher interest rates and increased instability in the banking sector as a result of several recent bank failures; our ability to respond to significant changes in prevailing interest rates and to resume profitable business operations; our ability to manage disruptions in the secondary home loan market, including the mortgage-backed securities market; our ability to finance and recover costs of our reverse servicing operations; our ability to manage changes in our licensing status, business relationships, or servicing guidelines with Ginnie Mae, HUD or other governmental entities; our geographic market concentration if the economic conditions in our current markets should decline or as a result of natural disasters; our use of estimates in measuring or determining the fair value of the majority of our financial assets and liabilities, which may require us to write down the value of these assets or write up the value of these liabilities if they prove to be incorrect; our ability to manage various legal proceedings and compliance matters, federal or state governmental examinations and enforcement investigations we are subject to from time to time, including consumer protection laws applicable to reverse mortgage lenders, which may be highly complex and slow to develop, and results are difficult to predict or estimate; our ability to prevent cyber intrusions and mitigate cyber risks; our ability to compete with national banks, which are not subject to state licensing and operational requirements; our holding company status and dependency on distributions from Finance of America Equity Capital LLC; our “controlled company” status under New York Stock Exchange rules, which exempts us from certain corporate governance requirements and affords stockholders fewer protections; and our common stock trading history has been characterized by low trading volume, which may result in an inability to sell your shares at a desired price, if at all. All of these factors are difficult to predict, contain uncertainties that may materially affect actual results and may be beyond our control. New factors emerge from time to time, and it is not possible for our management to predict all such factors or to assess the effect of each such new factor on our business. Although we believe that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and any of these statements included herein may prove to be inaccurate. Given the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements, or our objectives and plans will be achieved. Please refer to “Risk Factors” included in our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on March 16, 2023, for further information on these and other risk factors affecting us, as such factors may be amended and updated from time to time in the Company’s subsequent periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Disclaimer 2

The Finance of America Investment Thesis SECTION 1 Our Great Ambition page 4 Investment Thesis page 5 Opportunity Details page 6-7 A Path Forward page 8-9 3

O U R G R E A T A M B I T I O N Unlocking America’s Greatest Retirement Asset Finance of America is making home equity part of a mainstream, modern retirement so that more Americans can benefit from their untapped wealth later in life. The current approach to paying for retirement unfortunately ends in $4T of financial shortfalls nationally and impacts millions of seniors. 2 The solution lies in unlocking home equity as a retirement funding source with financing purpose- built for the 55+ homeowner. $13 Trillion SENIOR HELD HOME EQUITY1Melanie from Lafeyette, CO A Finance of America Customer Source 1) https://www.nrmlaonline.org/about/press-releases/senior-home- equity-levels-reach-13-08t-in-q3 ; Source 2 ) deloitte.com/us/en/insights/industry/financial-services/closing-retirement- savings-gap.html 4

Home Equity for Retirement is Ripe for Disruption Our Distinctive Advantages: 01 Clear Market Leadership Dominant Distribution Footprint Innovation Engine Capital Markets Strength Digital Capabilities Lifelong Commitment to Borrower Deep Industry Experience I N V E S T M E N T T H E S I S The category only sees a fraction of the $13T total home equity seniors hold. Finance of America is ideally situated to catalyze category growth and capture first-mover advantage. 02 03 04 05 06 07 5

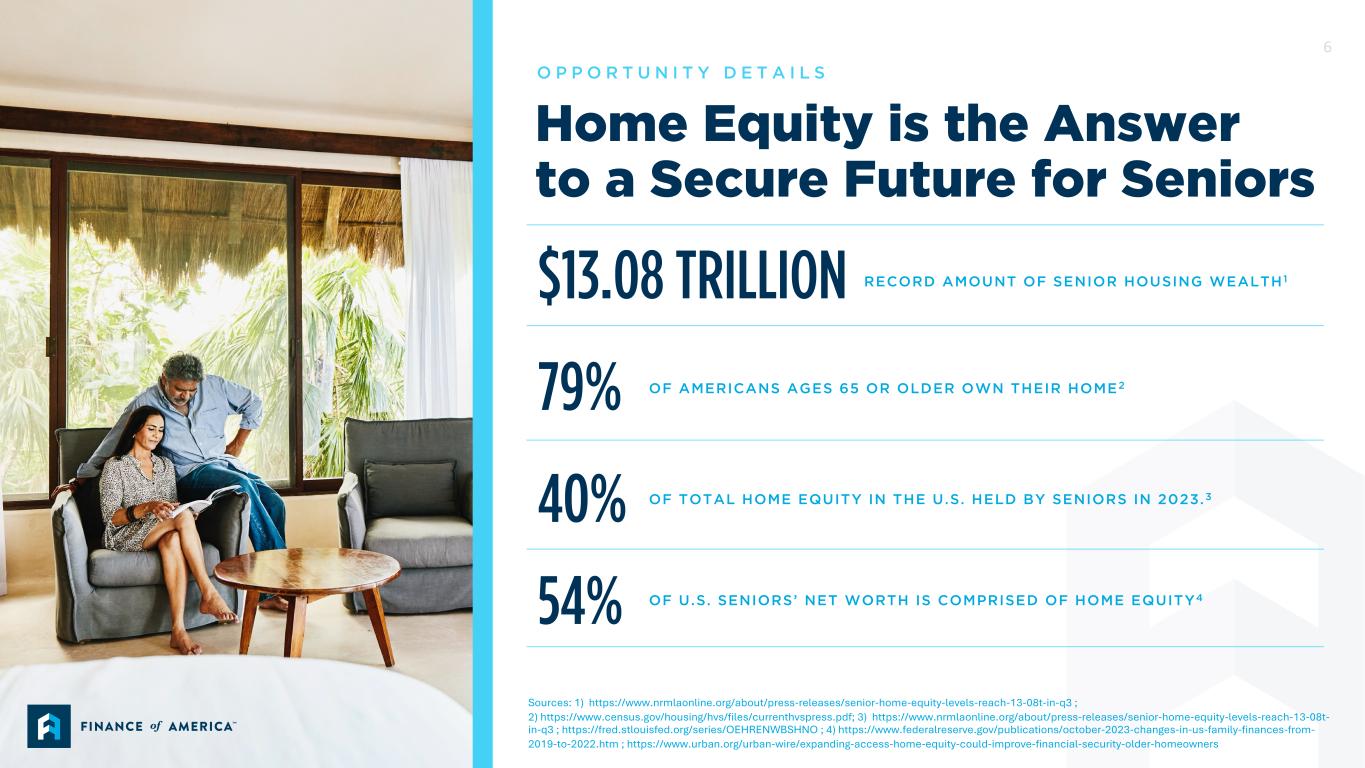

Home Equity is the Answer to a Secure Future for Seniors O P P O R T U N I T Y D E T A I L S $13.08 TRILLION RECORD AMOUNT OF SENIOR HOUSING WEALTH 1 79% OF AMERICANS AGES 65 OR OLDER OWN THEIR HOME2 Sources: 1) https://www.nrmlaonline.org/about/press-releases/senior-home-equity-levels-reach-13-08t-in-q3 ; 2) https://www.census.gov/housing/hvs/files/currenthvspress.pdf; 3) https://www.nrmlaonline.org/about/press-releases/senior-home-equity-levels-reach-13-08t- in-q3 ; https://fred.stlouisfed.org/series/OEHRENWBSHNO ; 4) https://www.federalreserve.gov/publications/october-2023-changes-in-us-family-finances-from- 2019-to-2022.htm ; https://www.urban.org/urban-wire/expanding-access-home-equity-could-improve-financial-security-older-homeowners 40% 54% OF U.S. SENIORS’ NET WORTH IS COMPRISED OF HOME EQUITY4 OF TOTAL HOME EQUITY IN THE U.S. HELD BY SENIORS IN 2023.3 6

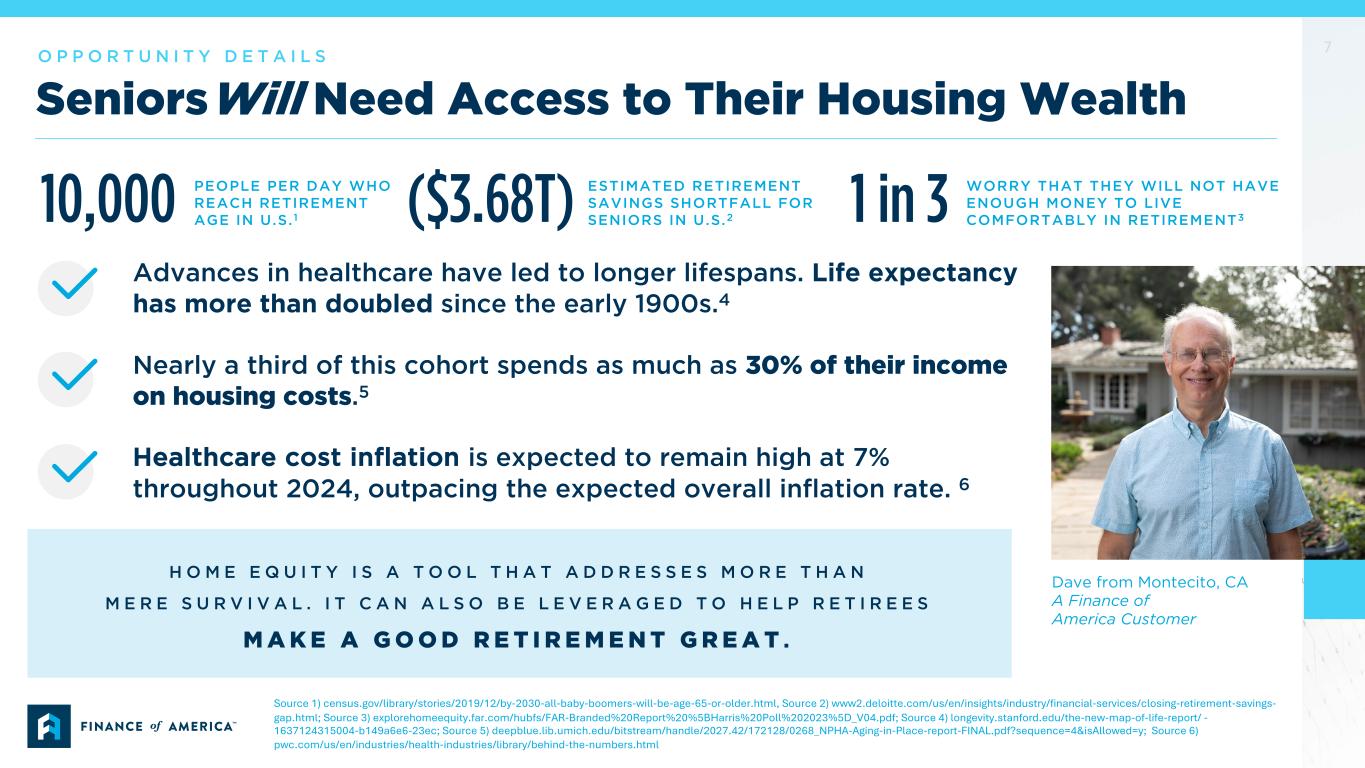

O P P O R T U N I T Y D E T A I L S 10,000 PEOPLE PER DAY WHO REACH RETIREMENT AGE IN U.S. 1 ($3.68T) ESTIMATED RETIREMENT SAVINGS SHORTFALL FOR SENIORS IN U.S.2 1 in 3 WORRY THAT THEY WILL NOT HAVE ENOUGH MONEY TO LIVE COMFORTABLY IN RETIREMENT3 Advances in healthcare have led to longer lifespans. Life expectancy has more than doubled since the early 1900s.4 Nearly a third of this cohort spends as much as 30% of their income on housing costs.5 Healthcare cost inflation is expected to remain high at 7% throughout 2024, outpacing the expected overall inflation rate. 6 Source 1) census.gov/library/stories/2019/12/by-2030-all-baby-boomers-will-be-age-65-or-older.html, Source 2) www2.deloitte.com/us/en/insights/industry/financial-services/closing-retirement-savings- gap.html; Source 3) explorehomeequity.far.com/hubfs/FAR-Branded%20Report%20%5BHarris%20Poll%202023%5D_V04.pdf; Source 4) longevity.stanford.edu/the-new-map-of-life-report/ - 1637124315004-b149a6e6-23ec; Source 5) deepblue.lib.umich.edu/bitstream/handle/2027.42/172128/0268_NPHA-Aging-in-Place-report-FINAL.pdf?sequence=4&isAllowed=y; Source 6) pwc.com/us/en/industries/health-industries/library/behind-the-numbers.html SeniorsWill Need Access to Their Housing Wealth Dave from Montecito, CA A Finance of America Customer H O M E E Q U I T Y I S A T O O L T H A T A D D R E S S E S M O R E T H A N M E R E S U R V I V A L . I T C A N A L S O B E L E V E R A G E D T O H E L P R E T I R E E S M A K E A G O O D R E T I R E M E N T G R E A T . 7

“As the world has changed, many maturing adults have been given the gift of an extra 20-30 years compared to previous generations. But this gift isn’t free. Hard work is needed to increase the odds of not only living longer, but also living well. Nobody said it will be easy, but putting a plan in place will help people arrive at old age physically fit, socially engaged, and financially secure.” - LIFE PLANNING IN THE AGE OF LONGEVITY: INSIGHTS FOR BOOMERS, 2017, STANFORD CENTER ON LONGEVITY Ann from Glendale, CA A Finance of America Customer A P A T H F O R W A R D 8

New Thinking Will Connect Consumer Needs & Solutions MAKE HOME EQUITY FOR RETIREMENT MAINSTREAM . Elevate our brand and financial product offerings to break the adoption barrier and offer a customer-centric experience that builds confidence and exceeds expectations. We believe these efforts can dramatically increase the number of customers we serve and enable them to thrive in retirement. 1Modernized Messaging 2Progressive Digital Experiences 3Unparalleled Customer Care 4Attract A New Kind of Borrower A P A T H F O R W A R D 9

The Finance of America Distinctive Advantages SECTION 2 Clear Market Leadership page 11 Dominant Distribution Footprint page 12 Digital Capabilities page 16-18 Lifelong Commitment to Borrower page 19 Innovation Engine page 13-14 Capital Markets Strength page 15 Deep Industry Experience page 20 10

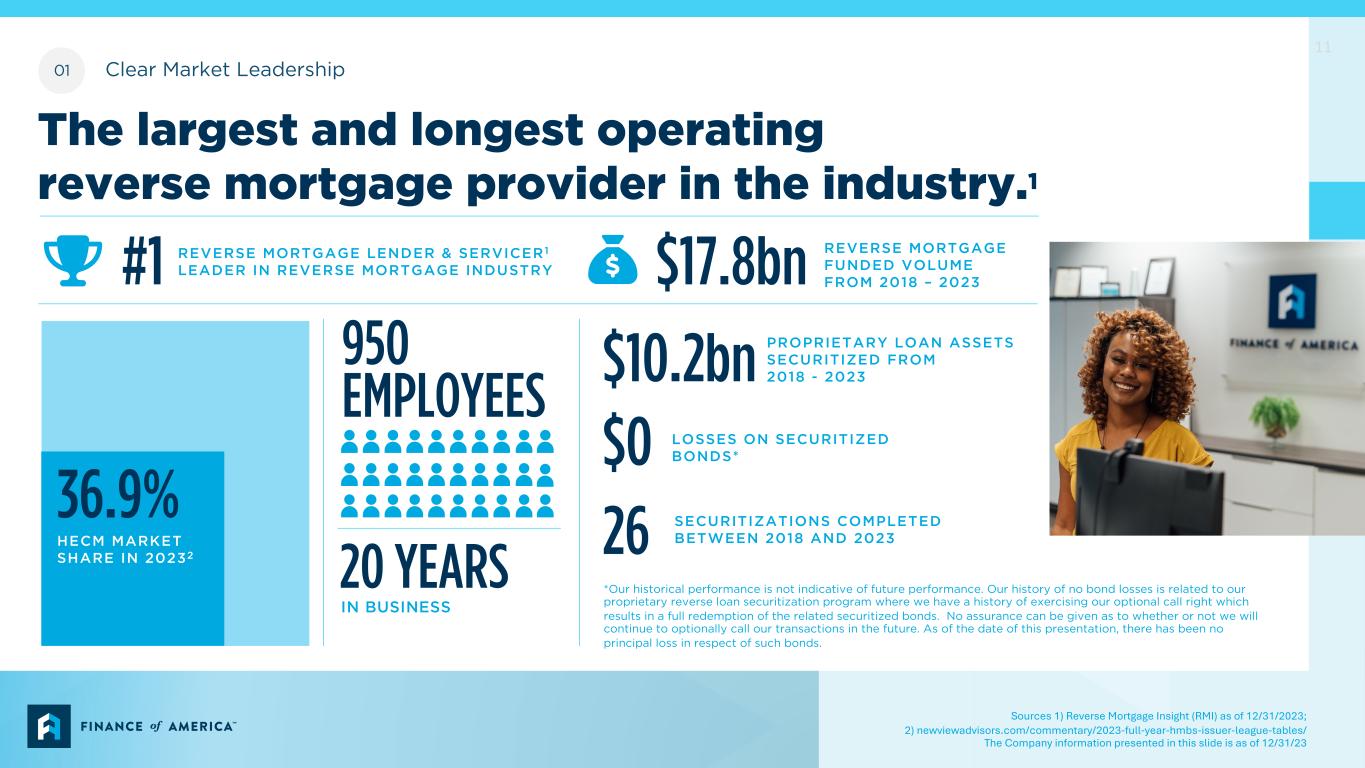

01 Clear Market Leadership 36.9% HECM MARKET SHARE IN 20232 $10.2bn PROPRIETARY LOAN ASSETS SECURITIZED FROM 2018 - 2023 26 SECURITIZATIONS COMPLETED BETWEEN 2018 AND 2023 $0 LOSSES ON SECURITIZED BONDS* 950 EMPLOYEES IN BUSINESS 20 YEARS #1 REVERSE MORTGAGE LENDER & SERVICER 1 LEADER IN REVERSE MORTGAGE INDUSTRY $17.8bn REVERSE MORTGAGE FUNDED VOLUME FROM 2018 – 2023 The largest and longest operating reverse mortgage provider in the industry.1 Sources 1) Reverse Mortgage Insight (RMI) as of 12/31/2023; 2) newviewadvisors.com/commentary/2023-full-year-hmbs-issuer-league-tables/ The Company information presented in this slide is as of 12/31/23 *Our historical performance is not indicative of future performance. Our history of no bond losses is related to our proprietary reverse loan securitization program where we have a history of exercising our optional call right which results in a full redemption of the related securitized bonds. No assurance can be given as to whether or not we will continue to optionally call our transactions in the future. As of the date of this presentation, there has been no principal loss in respect of such bonds. 11

A strong foundation for broad reach, distribution & influence. Retail Platform • Broad Marketing Reach with Advertising Reaching 20 million Consumers Annually • Over $1bn Advertising Investment Since Inception of the AAG Brand • State-of–the–art Call Center • Industry-leading Sales and Conversion Process • Multi-point Customer Journey • Leadership Position • Immense Scale • Growing Broker Originator Market • Activating and empowering brokers across the U.S. • Industry-leading Marketing Resources Platform • Thought Leadership and Education Wholesale Platform Strategic Partnerships *Advisor Workstation and the Advisor Workstation logo are service marks or trademarks of Morningstar and are used with permission. Morningstar is not affiliated with Finance of America and is not responsible for the contents of these materials or the performance of any products/services made available by Finance of America. 02 Dominant Distribution Footprint 12

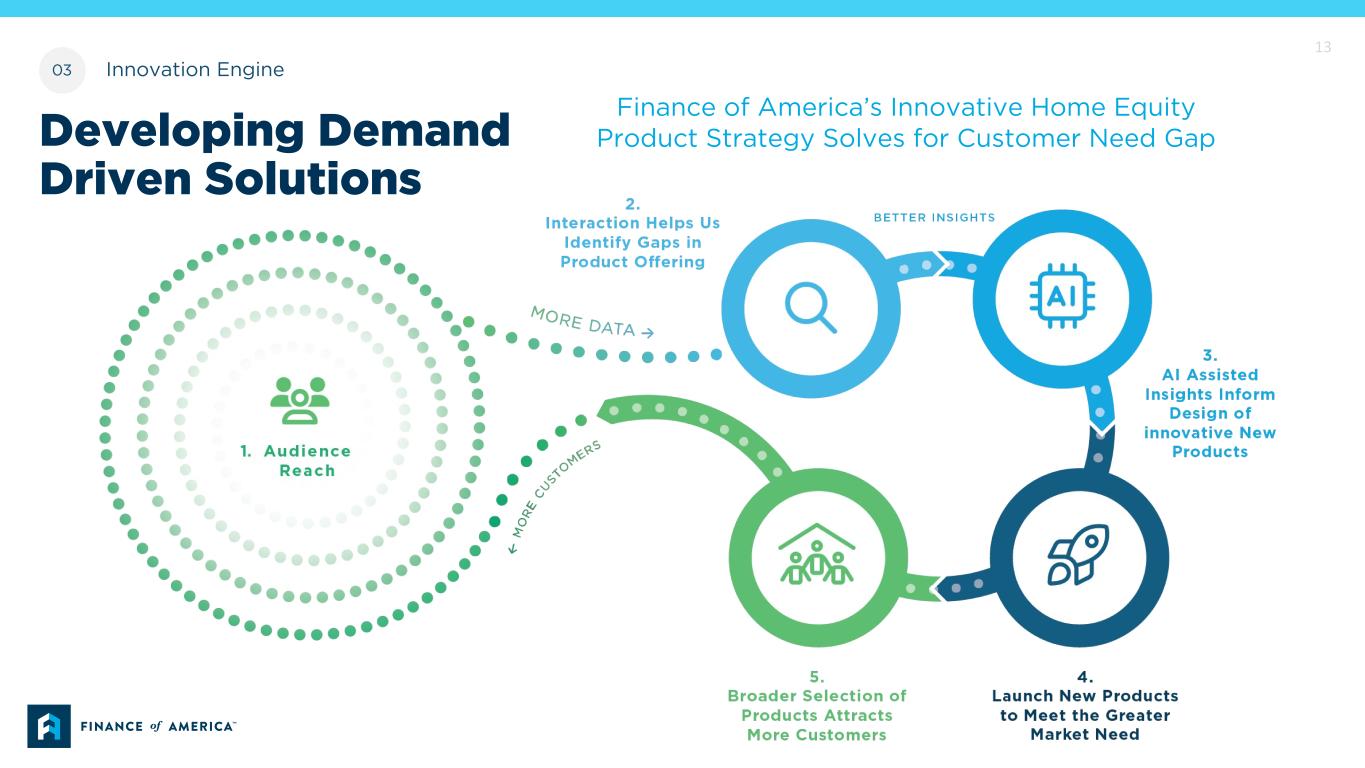

03 Innovation Engine Developing Demand Driven Solutions Finance of America’s Innovative Home Equity Product Strategy Solves for Customer Need Gap 13

Ann from Glendale, CA A Real Finance of America Customer Leading Product Franchise Finance of America is the industry leader in product innovation. We are the first in developing cutting-edge solutions to fill market gaps. Flagship Proprietary Jumbo Reverse Mortgage, Offers Loans up to $4m Nation’s Only Second Lien Reverse Mortgage that Allows Borrowers to Keep a Low-rate Forward 1st Mortgage Agency Product, FHA Insured Loans (Must be age 62+) Ground-Breaking Retirement Mortgage Combining Elements of a Forward and Rev se Mortgage A L L P R O D U C T S D E L I V E R C A S H F L O W B E N E F I T S , D E S I G N E D F O R L I F E A F T E R 5 5 * 03 Innovation Engine *Subject to State Age Requirements and Availability 14

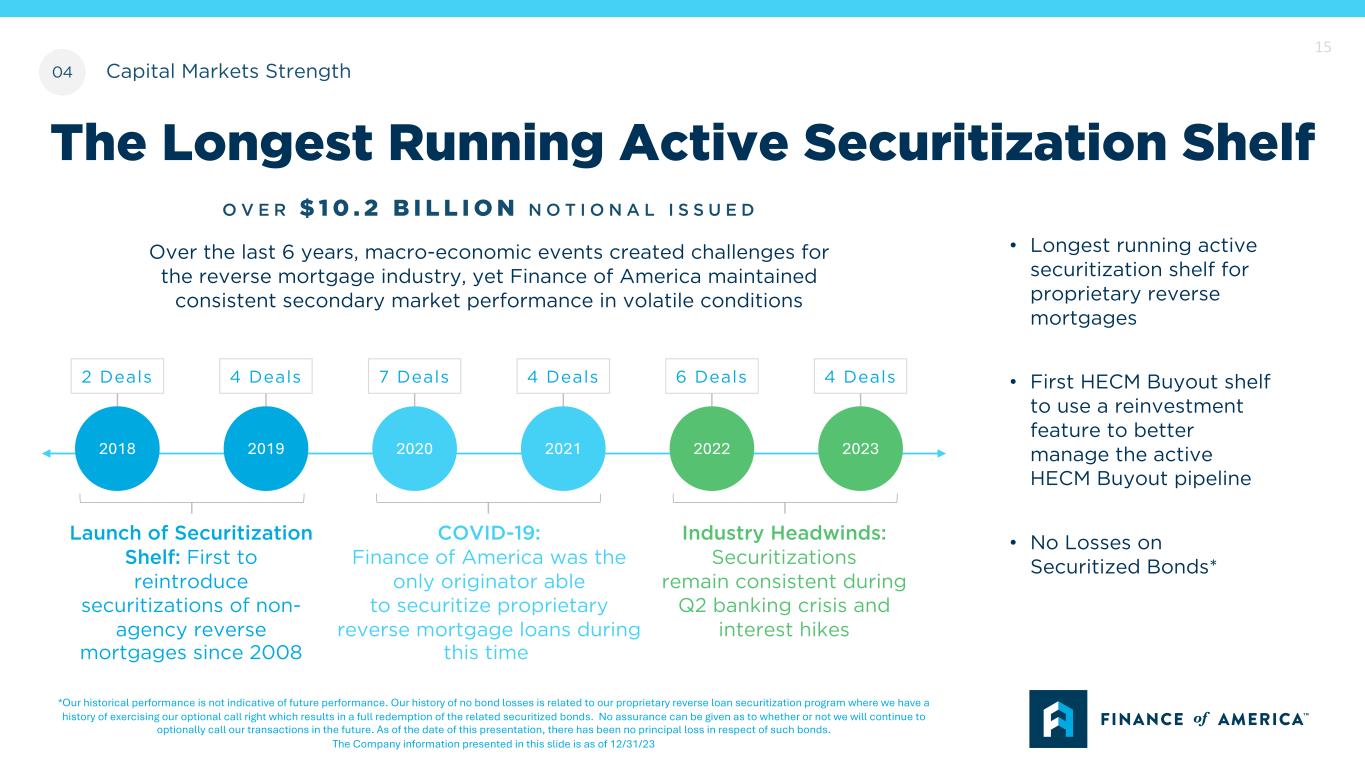

04 Capital Markets Strength • Longest running active securitization shelf for proprietary reverse mortgages • First HECM Buyout shelf to use a reinvestment feature to better manage the active HECM Buyout pipeline • No Losses on Securitized Bonds* O V E R $ 1 0 . 2 B I L L I O N N O T I O N A L I S S U E D Launch of Securitization Shelf: First to reintroduce securitizations of non- agency reverse mortgages since 2008 COVID-19: Finance of America was the only originator able to securitize proprietary reverse mortgage loans during this time Over the last 6 years, macro-economic events created challenges for the reverse mortgage industry, yet Finance of America maintained consistent secondary market performance in volatile conditions Industry Headwinds: Securitizations remain consistent during Q2 banking crisis and interest hikes The Longest Running Active Securitization Shelf 2018 2 Deals 2019 4 Deals 2020 7 Deals 2021 4 Deals 2022 6 Deals 2023 4 Deals *Our historical performance is not indicative of future performance. Our history of no bond losses is related to our proprietary reverse loan securitization program where we have a history of exercising our optional call right which results in a full redemption of the related securitized bonds. No assurance can be given as to whether or not we will continue to optionally call our transactions in the future. As of the date of this presentation, there has been no principal loss in respect of such bonds. The Company information presented in this slide is as of 12/31/23 15

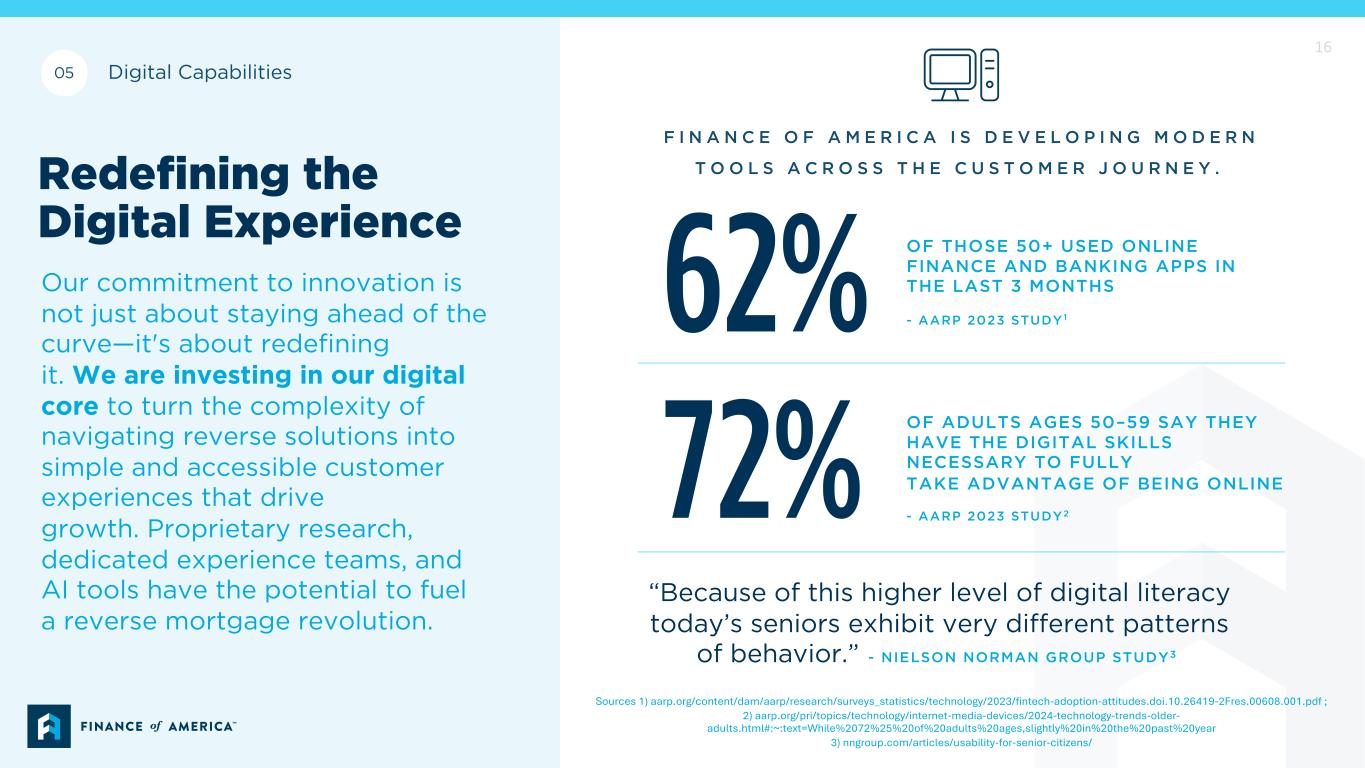

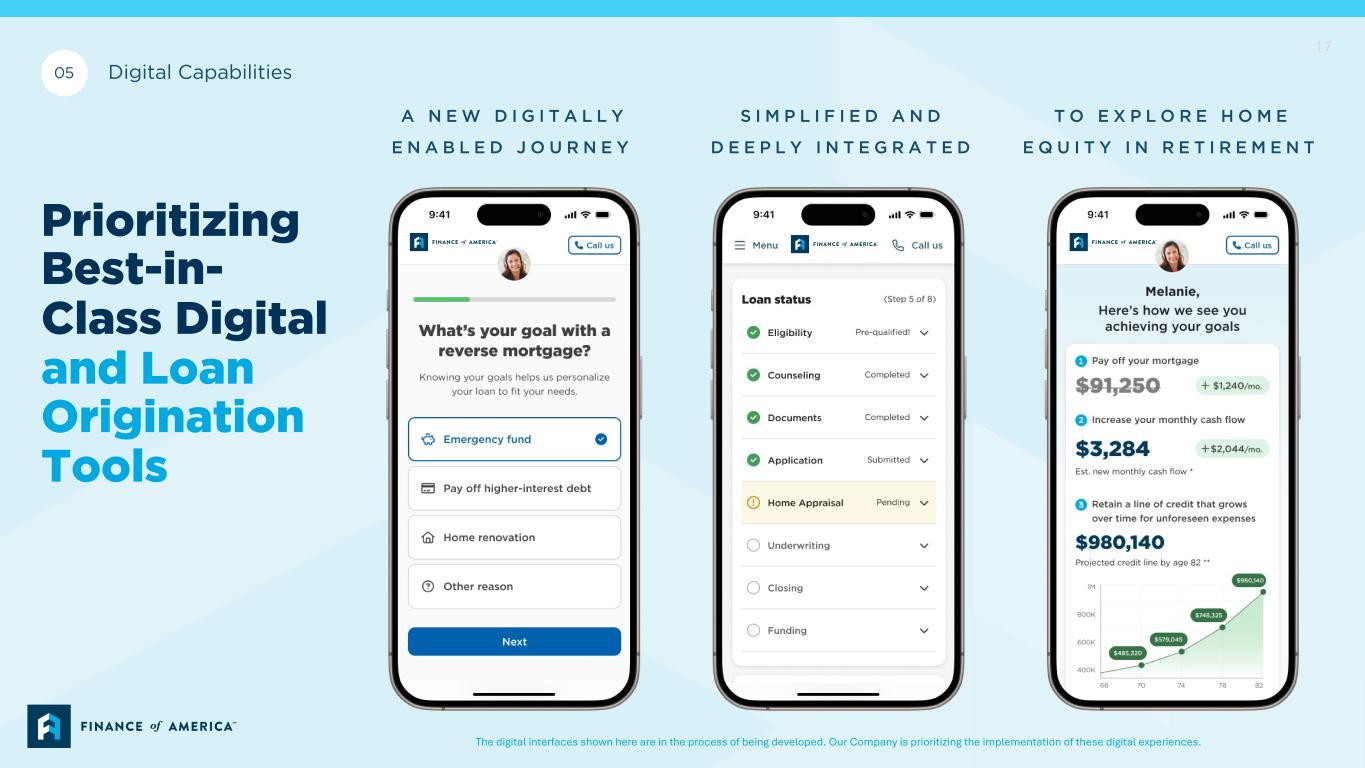

05 Digital Capabilities Redefining the Digital Experience Our commitment to innovation is not just about staying ahead of the curve—it's about redefining it. We are investing in our digital core to turn the complexity of navigating reverse solutions into simple and accessible customer experiences that drive growth. Proprietary research, dedicated experience teams, and AI tools have the potential to fuel a reverse mortgage revolution. F I N A N C E O F A M E R I C A I S D E V E L O P I N G M O D E R N T O O L S A C R O S S T H E C U S T O M E R J O U R N E Y . 62% OF THOSE 50+ USED ONLINE FINANCE AND BANKING APPS IN THE LAST 3 MONTHS - AARP 2023 STUDY 1 72% OF ADULTS AGES 50–59 SAY THEY HAVE THE DIGITAL SKILLS NECESSARY TO FULLY TAKE ADVANTAGE OF BEING ONLINE - AARP 2023 STUDY2 “Because of this higher level of digital literacy today’s seniors exhibit very different patterns of behavior.” - NIELSON NORMAN GROUP STUDY3 16 Sources 1) aarp.org/content/dam/aarp/research/surveys_statistics/technology/2023/fintech-adoption-attitudes.doi.10.26419-2Fres.00608.001.pdf ; 2) aarp.org/pri/topics/technology/internet-media-devices/2024-technology-trends-older- adults.html#:~:text=While%2072%25%20of%20adults%20ages,slightly%20in%20the%20past%20year 3) nngroup.com/articles/usability-for-senior-citizens/

Prioritizing Best-in- Class Digital and Loan Origination Tools A N E W D I G I T A L L Y E N A B L E D J O U R N E Y S I M P L I F I E D A N D D E E P L Y I N T E G R A T E D T O E X P L O R E H O M E E Q U I T Y I N R E T I R E M E N T 05 Digital Capabilities The digital interfaces shown here are in the process of being developed. Our Company is prioritizing the implementation of these digital experiences. 17

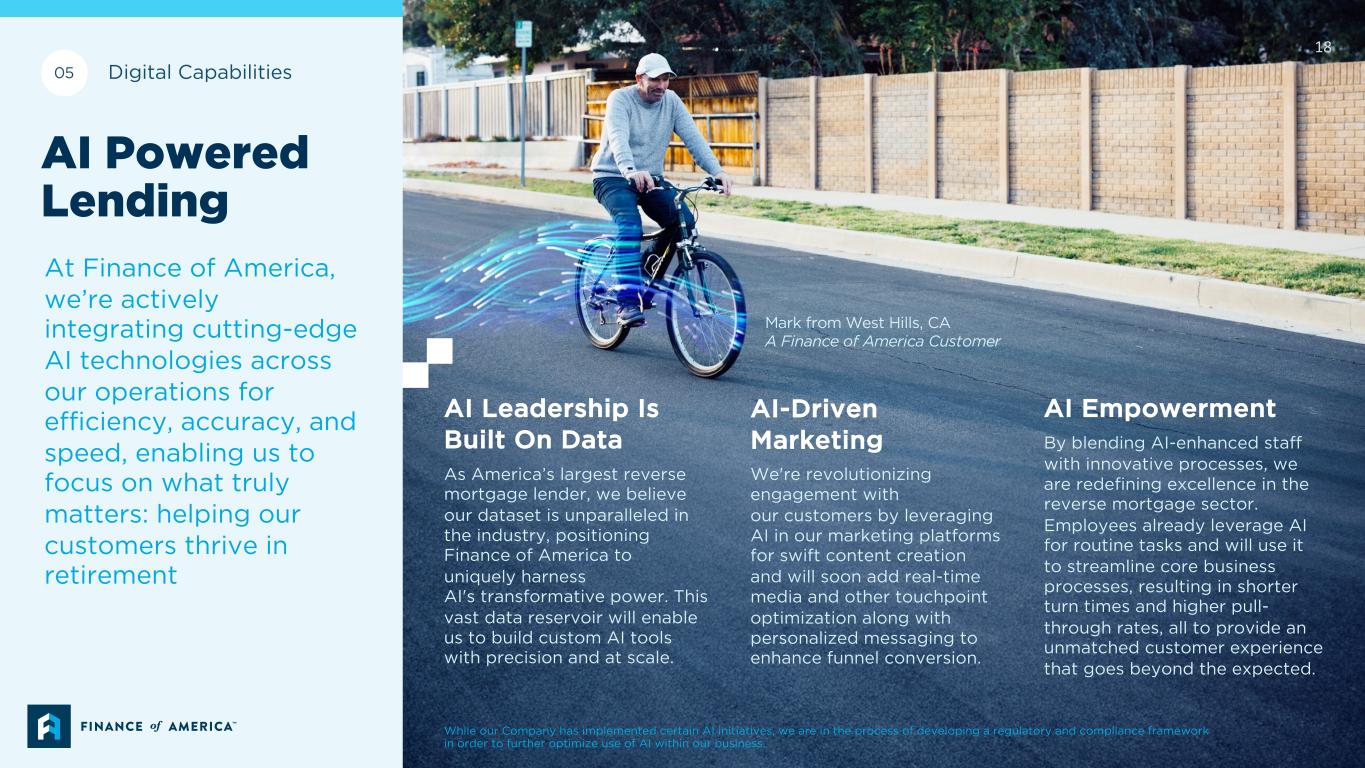

AI Powered Lending At Finance of America, we’re actively integrating cutting-edge AI technologies across our operations for efficiency, accuracy, and speed, enabling us to focus on what truly matters: helping our customers thrive in retirement AI-Driven Marketing We're revolutionizing engagement with our customers by leveraging AI in our marketing platforms for swift content creation and will soon add real-time media and other touchpoint optimization along with personalized messaging to enhance funnel conversion. AI Empowerment By blending AI-enhanced staff with innovative processes, we are redefining excellence in the reverse mortgage sector. Employees already leverage AI for routine tasks and will use it to streamline core business processes, resulting in shorter turn times and higher pull- through rates, all to provide an unmatched customer experience that goes beyond the expected. AI Leadership Is Built On Data As America’s largest reverse mortgage lender, we believe our dataset is unparalleled in the industry, positioning Finance of America to uniquely harness AI's transformative power. This vast data reservoir will enable us to build custom AI tools with precision and at scale. 05 Digital Capabilities Mark from West Hills, CA A Finance of America Customer While our Company has implemented certain AI initiatives, we are in the process of developing a regulatory and compliance framework in order to further optimize use of AI within our business. 18

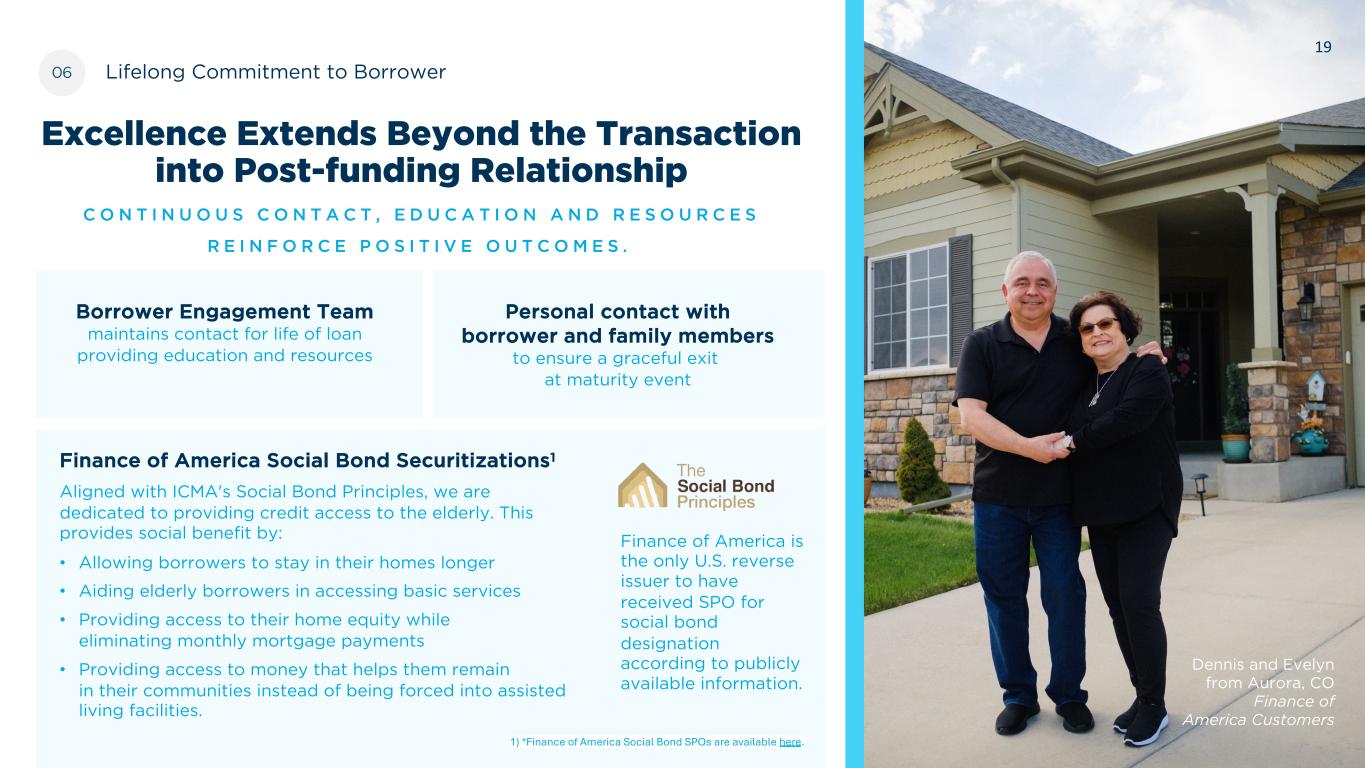

Dennis and Evelyn from Aurora, CO Finance of America Customers Excellence Extends Beyond the Transaction into Post-funding Relationship C O N T I N U O U S C O N T A C T , E D U C A T I O N A N D R E S O U R C E S R E I N F O R C E P O S I T I V E O U T C O M E S . Personal contact with borrower and family members to ensure a graceful exit at maturity event Borrower Engagement Team maintains contact for life of loan providing education and resources Finance of America Social Bond Securitizations1 Aligned with ICMA's Social Bond Principles, we are dedicated to providing credit access to the elderly. This provides social benefit by: • Allowing borrowers to stay in their homes longer • Aiding elderly borrowers in accessing basic services • Providing access to their home equity while eliminating monthly mortgage payments • Providing access to money that helps them remain in their communities instead of being forced into assisted living facilities. Finance of America is the only U.S. reverse issuer to have received SPO for social bond designation according to publicly available information. 1) *Finance of America Social Bond SPOs are available here. 06 Lifelong Commitment to Borrower 19

Finance of America Companies is led by a close-knit group of long-time colleagues with deep industry expertise. Graham Fleming CEO 25 years in mortgage 07 Deep Industry Experience Kristen Sieffert President 20 years in mortgage Matt Engel Chief Financial Officer 30 years in mortgage Jeremy Prahm Chief Investment Officer 20 years in mortgage Lauren Richmond Chief Legal Officer and General Counsel; Secretary 8 years in mortgage 20

Let’s Unlock America’s Greatest Retirement Asset For more information visit us online: IR.FinanceOfAmerica.com Or email us at: IR@FinanceOfAmerica.com 21

A P P E N D I X

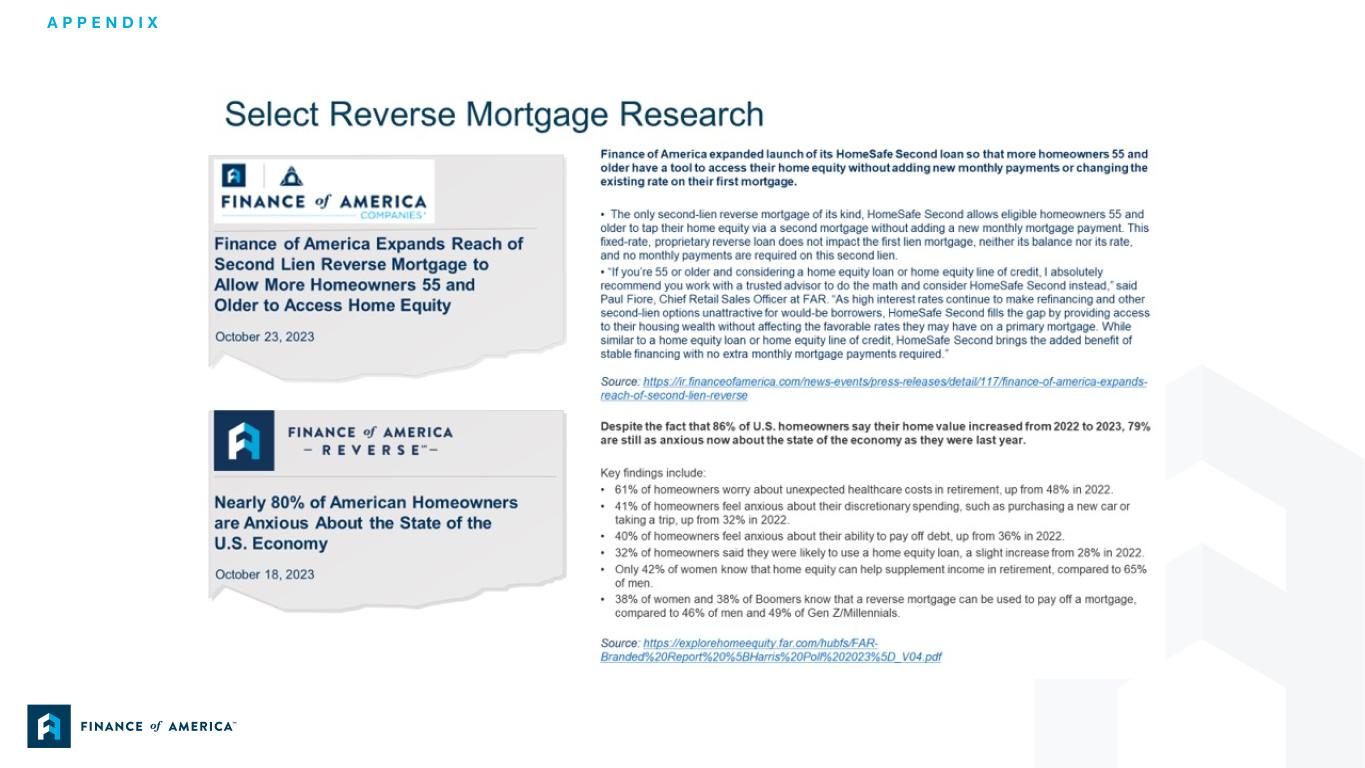

A P P E N D I X

A P P E N D I X