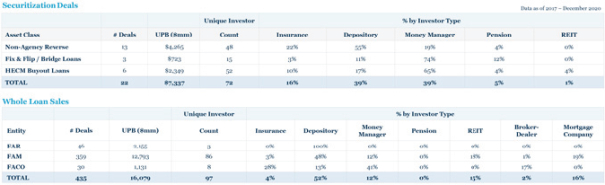

capabilities. These capabilities allowed us to complete profitable sales of our loan products via 10 securitization in 2020, demonstrating the high quality and liquidity of the loan products we originate, the deep relationships we have with our investors and the resilience of our business model in any market environment.

We have two distinct advantages in our industry:

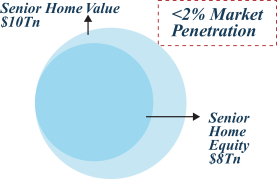

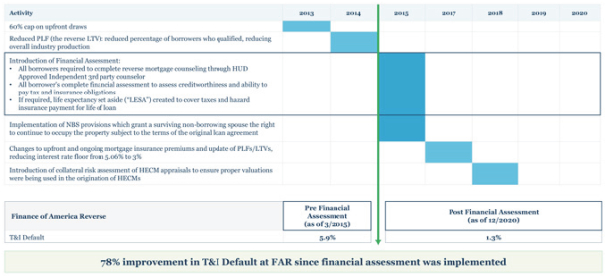

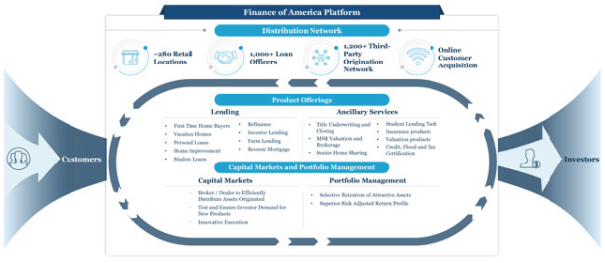

Product Innovation: Most lenders identify an investor (for example, Fannie Mae), and generate products for that existing investor. We also originate for existing investors when it is profitable to do so. However, our origination-to-investor platform collects data from both borrowers and investors, which gives us valuable insights into their unmet needs, allowing us to create innovative products that serve more of our customers’ lending needs over time. For example, at a time when HECMs insured by HUD were the only reverse mortgage loan product available to consumers, we developed a proprietary suite of reverse mortgage products, launched in 2014. We had the leading proprietary product in the market for approximately four years, and have continued as the market leader due to our ability to enhance and expand the product to meet consumer demand, while ensuring that we developed a viable exit strategy for the product through securitizations.

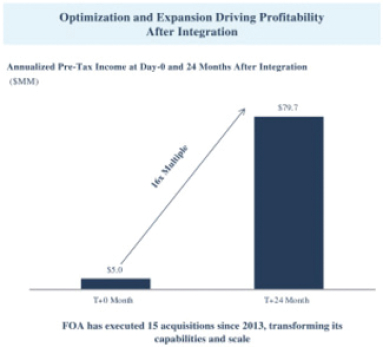

Strategic Business Acquisitions: Since our formation in 2013 through the year ended December 31, 2020, we have successfully acquired, integrated, expanded and optimized 15 companies in industries spanning from originations and lender services to capital markets. We have explored opportunities for many others. We only purchase a business after a careful analysis, focusing on (i) whether the business is strategic to our model, (ii) whether it has significant growth opportunities, and (iii) if we can add value to the acquired business, whether through financial strength, greatly expanded marketing capability, improved execution, quality and efficient shared services, or otherwise.

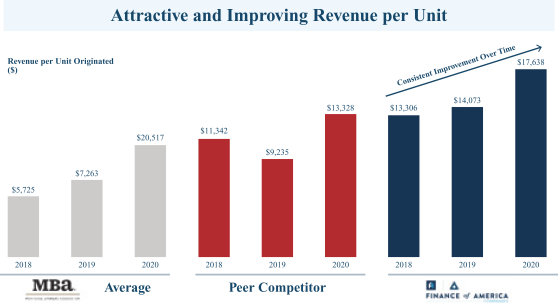

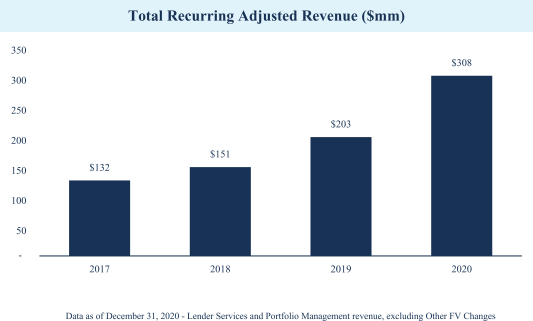

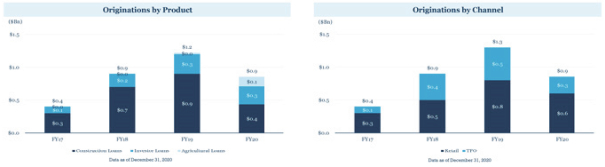

Our ability to efficiently support multiple lending products and focus resources to the products most needed in the market allows us to take advantage of market opportunities where they are presented and to counter cyclical fluctuations in earnings experienced by most traditional mortgage companies and monoline lenders. We demonstrated this capability in 2018, where we saw growth in earnings in our Reverse and Commercial segments during an exceptionally difficult time for the traditional mortgage market. As a result, between 2017 and 2018, we grew revenue by 1.4% and Adjusted EBITDA by 50.5%. From the period beginning January 1, 2017 through December 31, 2020, the compound annual growth rate of our total revenue was 32%. Additionally, our revenue per unit originated shows consistent improvement over time, growing from $13,306 in 2018 to $17,638 in 2020.

141